Grants Accounting

Contact

Grants Accounting77 Mac Room 302b 651-696-6354

651-696-8282 (fax)

grantsaccounting@macalester.edu

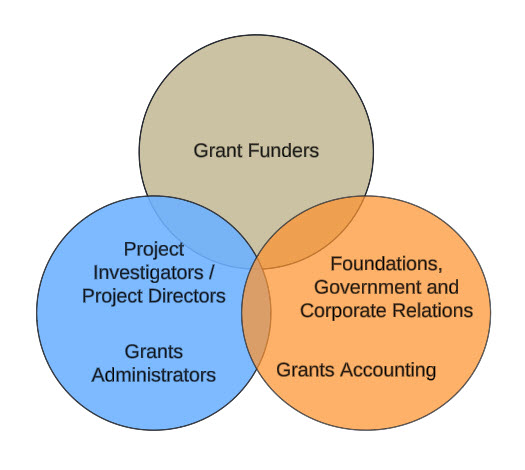

Grants Accounting resides within the Accounting Department, which is part of Business Services at Macalester College. Grants Accounting works closely with Foundation, Government and Corporate Relations to ensure seamless administration of projects from proposal to grant close-out.

Grants Accounting is responsible for post-award financial administration of all externally funded grants. This includes:

- Working with Principal Investigators (PI’s) and Project Directors (PD’s) one-on-one to ensure that every grant gets off on the right foot and remains in compliance with all internal and external requirements.

- Reviewing grant expenses for compliance with college and sponsor policies and guidelines.

- Monitoring budgets and taking action, as necessary, to seek approved revisions or extend project timelines.

- Preparing financial reports for submission to funders, as required by the grant award terms.

- Working with PI/PD’s on extensions, budget revisions, planning, and estimating.

Consistent with the Business Services department mission, we strive to provide “Exceptional Service— Without Exception” to our customers while ensuring compliance with all Macalester, federal, state, and private sponsor policies and guidelines.

Resources

Top 10 Grants Administration Questions

- How will the financial accounting work for my grant?

- What is my grant’s FOAPAL and where can I find it?

- How do I know what expenses can be charged to my grant?

- How do I request summer salary from my grant?

- How do I book grant-funded travel? Are there any restrictions?

- What are indirect costs and how do they affect my grant?

- Can I run a report to see the transaction detail of my grant expenses?

- Who prepares the grant financial reports?

- I would like to do some financial planning on my grant. Who do I contact?

- What is my unspent grant balance?

What if my question is not here? Check on Grants Accounting FAQ page.