Taxes

Contact

International Student ProgramsKagin Commons, First Floor +1 (651) 696-6992 (tel)

+1 (651) 696-6806 (fax)

isp@macalester.edu

facebook instagram

Hours

2024-25 Important Dates

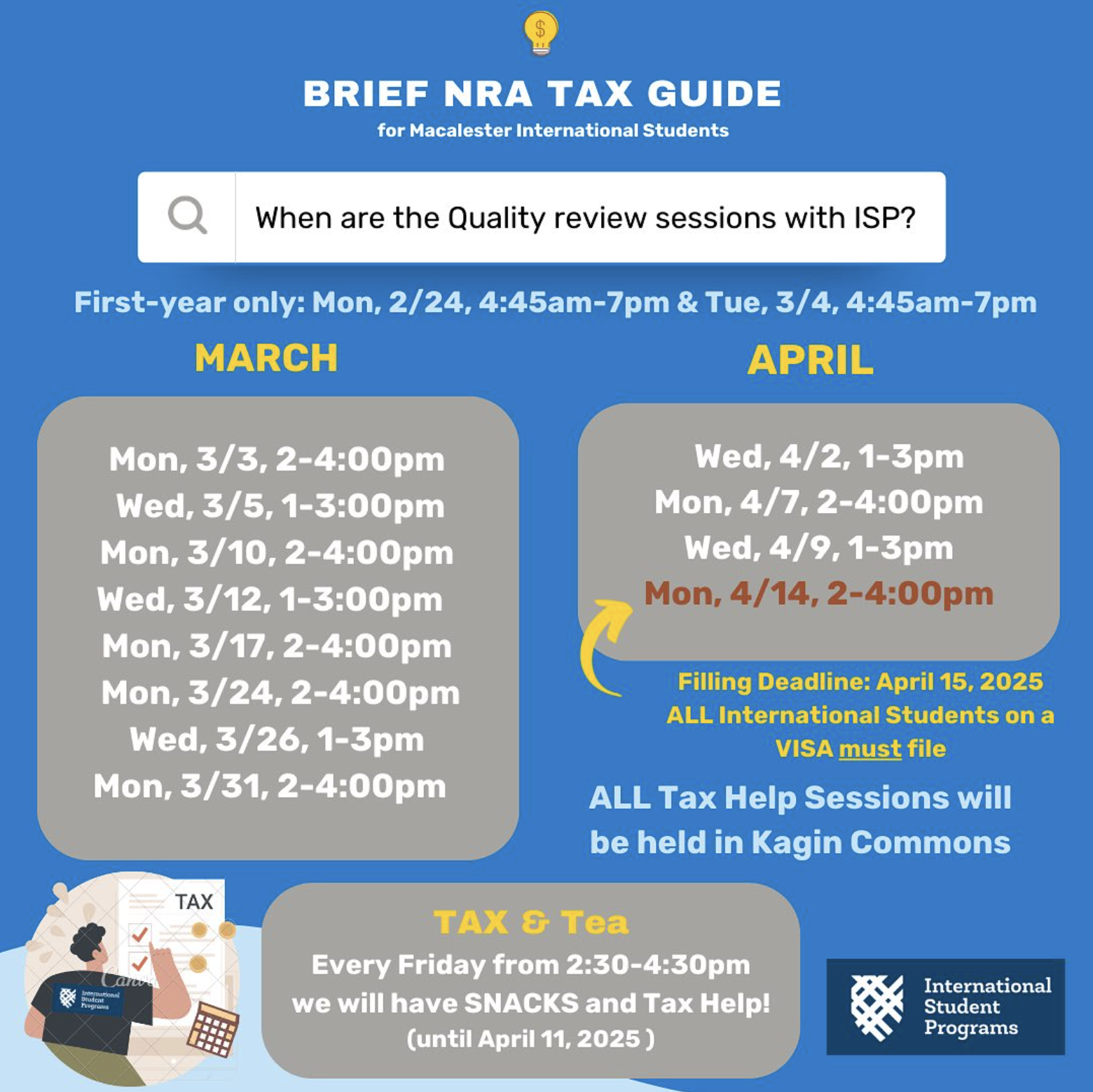

You MUST attend the tax help session(s) to review and file your returns. ISP is no longer offering individual tax help; check your email for the session dates.

- Tax Filing Deadline April 15, 2025

- Last Day of ISP Tax Help April 14, 2025

Upcoming Tax Session

Tools

Steps to File Taxes

-

ISP staff is only trained to assist currently enrolled students who are Non-Resident Aliens for Tax Purposes, which include:

- F-1 students whose presence in the U.S. does not exceed 5 calendar years (this often applies to current students and alumni within the calendar year after graduation, unless they were in the U.S. before Macalester). For example, if Joe came to Macalester with an F-1 visa in 2020, they would become a resident alien for tax purposes starting January 1, 2025. They would still file their taxes for 2024 as non-resident aliens.

- J-1 students/scholars whose presence in the U.S. does not exceed 2 calendar years.

If your presence in the U.S. exceeds the time frames mentioned above and you are a Resident Alien (RA) for Tax Purposes, see the section for Resident Alien (RA) for Tax Purposes below. GLACIER’s Tax Summary Report will tell you what your tax residency status is. You can also use the Am I a Nonresident Alien? tool by NRVTAP. If you are still unsure, check with ISP.

-

For more details on the purpose of each of the documents below and how to retrieve them, please refer to the 2024 Tax Preparation document.

Work income statements

W-2 (income statement):

- If you had any paid employment during 2024, you will most likely have received a W-2 from your employer(s). If you haven’t received a W-2 or other income statement, e.g. 1099, please request immediately from your employer.

- If you worked at Macalester and chose to receive your W-2 electronically, log into 1600Grand → Money Matters → Employee Dashboard → Taxes → W-2 → Printable W-2; print 1 copy. Make sure you print landscape or part of the form might get cut off; otherwise bring the one that you got in your SPO. Check with ISP if we have your Macalester W-2.

1042-S income form:

If you claimed a tax treaty with the U.S. and worked at Macalester, your employment income is reported on a Form 1042-S rather than a W-2.

1099 income form:

Some employers may give you various versions of Form 1099 for any income earned from CPT or work with them.

Taxable financial aid, gift cards, tax treaty, etc.

1042-S

Other documents

Previous year(s) tax return(s):

If you filed federal or state taxes in the previous year(s), have that information with you.

Taxable Grant Memo and/or scholarship tax information:

Depending on your financial aid, this will be part of the documents that GTP will create for your FEDERAL tax return (not Tax Summary Report in GLACIER).

Travel Documents: passport, I-20, travel history from the I-94 site.

Social Security Number (if you have one, i.e., if you’ve ever worked for money in the U.S.)

Bank account information (account and routing number), in case you will receive a refund.

-

First-years and New transfer students: Your Tax Sessions (dates sent by Luyen) will be a workshop, where you will have a info session portion AND a working portion. Please do not stress too much about having everything done before the sessions.

Returning students: Your Tax session will be a Quality Review session. Follow the instructions on our website carefully. (You may come to ISP office workers for questions, but it is your responsibility to follow the instructions)

- GTP is an online tax preparation site (accessed through GLACIER) to prepare your federal taxes.

- GTP does not file your taxes for you–software only prepares the documents to be sent by mail.

- If you have to file state tax, ISP will help prepare your MN state tax after reviewing your federal tax return.

- You should have registered for GLACIER during PO4IS and created your username/login. If you don’t remember it, click “forgot login.”

- Use a password that is easy to remember or keep a note of it somewhere.

How do I complete Glacier Tax Prep (GTP)?

- Click the green link “Complete my US Tax return using GLACIER Tax Prep (or GTP).” – If you choose any other link like View/Update that is the wrong link – it will not complete your federal tax return.

- Click through and complete all personal information.

- For the country of tax residence, most students will put the country from their passport. If in doubt, talk to ISP.

- On the page “Information about your visits to the US,” refer to your passport stamps or I-20 to get arrival dates. Enter the dates as accurately as you can. We recommend looking up your U.S. travel history from the I-94 site, although it may not be complete. After you submit it, GTP will tell you your residency status on a page that says “You are a Non-Resident/Resident for Tax Purposes.” You are not able to put 2025 dates because this is only relevant up to the 2024 tax year.

- On the page “Income Statements” copy all your income forms into the appropriate yellow fields, exactly as how they appear on paper. Most students have a W-2 and/or a 1042-S, but you may also have only one or the other, or none. If you had paid internships in Minnesota or out of state, you will have one W-2 (or other income statement) per workplace. If your employer considered you an independent contractor, then you may receive a 1099-NEC or 1099-MISC. You should have one income statement from each employer. You may have also received another type of 1099 form. If you don’t know where to find these forms, see “What forms do I need to complete Glacier Tax Prep?” above.

- On the next page, when asked about your tax treaty, click “I want to claim the maximum amount of exemption.” You may also want to check the summary of your tax treaty to make sure it is the best option for you. If your country doesn’t have a tax treaty, this page may not appear.

- On the page “Institution that Sponsored your Immigration Status,” put Luyen Phan as the designated school official. Luyen’s telephone number is 651- 696-6849.

- On the section “Additional Information” (you can check your previous federal tax documents on GLACIER):

- Did you ever make estimated tax payments? No.

- Have you ever filed a previous tax return? If you didn’t file US taxes last year, NO. If you did, YES. Most students completed the 1040NR prior to the 2024 tax year.

- On your Form 1040NR (or 1040NR-EZ prior to 2020), were you eligible for a tax refund that you instructed the IRS to keep and apply to any refund that you may have in 2023? No.

- Did you claim the tax treaty benefit?If you haven’t filed taxes before, no. If you did, hopefully you put yes last time, so yes.

- Do you have any dependents? No, unless you have children or a spouse.

- Did you pay any interest? This may apply to those of you who graduated and started paying interest on your student loans. Check Form 1098-E that you should have already received.

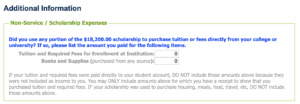

- On the section “Additional Information”, on the page Non-Service / Scholarship Expenses in GLACIER Tax Prep (GTP), example below:

You should not fill out this section if you never received this money directly to your bank account or as a check. Most students get this money directly applied to the costs of Room and Board, so they can’t decide to use this money for tuition or books.If you did receive any part or the full amount of this scholarship, only report the amounts that were used on “Tuition and Required Fees for Enrollment at Institution” and “Books and Supplies (purchased from any source)” YOU MUST HAVE receipts.

You should not fill out this section if you never received this money directly to your bank account or as a check. Most students get this money directly applied to the costs of Room and Board, so they can’t decide to use this money for tuition or books.If you did receive any part or the full amount of this scholarship, only report the amounts that were used on “Tuition and Required Fees for Enrollment at Institution” and “Books and Supplies (purchased from any source)” YOU MUST HAVE receipts. - If you are due a refund, GTP will ask you how you would like to receive your tax refund. We recommend direct deposit as the faster and easier route. Make sure you know your bank account and routing numbers. Getting your refund may take up to between a month and a year.

- Click the green button that says “print forms.” Do not print the instruction page, start by printing from page 2.Print one double sided copy. If you have a 1042-S, print ONE COPY SINGLE-SIDED from GLACIER. Note: These are NOT the “Tax Summary” forms.

Congratulations! You have finished your federal forms through Glacier Tax Prep – do not mail or pay any money until ISP reviews your federal return and if needed, ISP will help prepare MN state return.

- GTP is an online tax preparation site (accessed through GLACIER) to prepare your federal taxes.

-

* To receive this year’s TaxSlayer link, you must correctly fill out the Tax Survey. Make sure you finish Federal Return via GTP BEFORE filling out the survey.

If you are an NRA and were NOT able to complete the survey…

Retrieve all necessary documents and fix the error(s) shown.

Complete Glacier Tax Prep (GTP).

Fill out this Tax Survey from the beginning. Your previous answers are not saved.

If you are an NRA and completed the survey…

Check your inbox for the summary of this survey and the TaxSlayer link.

Show up to the Tax Help Session(s) that you signed up for. Even if you only have the Form 8843, you still must attend one of the sessions.

If you are an exchange student…

Please look out for an email from one of the ISP student staff to your Macalester email.

-

If after completing the Tax Season Help Survey (Section 4) you need to continue your federal and state tax returns in TaxSlayer (because you have more than Form 8843 as part of your federal return in GTP), refer to ISP emails sent with the special TaxSlayer software link. You must complete TaxSlayer prior to coming to ISP to have your return reviewed before you file.

Tax Treaty – Use this resource to find out whether your country has a tax treaty with the United States. You should not need to create an account from the website, but if asked please do so. You can also review GTP-produced Form 1040-NR → Schedule OI → Line L for additional help.

The instructions are from tax year 2023; however, they are still applicable to this year’s filing.

1. [Federal] Three Basic Scenarios

* Select the scenario that matches your situation

- 2023 Treaty Benefits Do Not Match 1042-S (PDF) (If you have a tax treaty but didn’t claim it so received W-2 instead or got both a W-2 AND 1042-S for work income you must also follow these instructions)

2. [State] MN Return Instructions

3. You might also have these special scenarios:

Investment Income (PDF) (e.g., 1099-INT, 1099-DIV, 1099-B)

DO NOT E-FILE YET! Have your completed federal and state returns reviewed by two (2) ISP staff before you can e-file.

-

Tax Help & Quality Review Sessions

In Spring 2025, group sessions for 2024 taxes will be hosted by ISP to review and file your federal taxes (prepared using GTP) as well as file state taxes (MN for all, other states for some). ISP is no longer offering individual tax help.

Bring the following to your tax session:

One copy of your Glacier Tax Prep forms (do not print out the first page instruction sheet)

Print out any applicable tax income forms (W-2, 1042-S, 1099, etc)–see where to find these above

I-20

Passport

Social security number (SSN)

Financial aid letters (memos) you might have received from federal forms produced by GTP

Bank account if you have one in case you need to pay additional taxes and bank account information (account and routing number) in case you will receive a refund.

Show up to the session on time! Filing taxes usually takes one (1) hour or more, so plan accordingly. -

You must get your return reviewed by two (2) ISP tax help staff BEFORE you e-file.

Rejection Codes

If your tax return has been rejected, please identify the specific rejection code. Below are some common rejection codes and resolution steps.

Common Rejection Codes

- F1040-065: federal payment and refund $0

Next Steps

- Locate your rejection code in the list above.

- Follow the resolution steps.

- Resubmit your corrected return promptly.

Additional Support

If your rejection code is not listed above, please email ISP immediately with a screenshot of the error message attached to isp@macalester.edu

-

Filing Taxes for Other States

If you have worked in a state other than Minnesota, we will still help you to review and complete your federal taxes. However, we will not be able to help you complete your out of state taxes this year. We will direct you to a service that can complete your state taxes for you. Please still attend the session(s) to get more information and have your federal taxes reviewed.

Rental Refund

If you paid rent in MN during 2024, depending on your income and many other variables, you may be eligible for a Renter’s Property Tax Refund. This is very rare for Macalester students since they don’t usually meet the income requirements (scholarship, loans or money from families may be considered income). See more information on the Renter’s Property Tax Refund page of the Minnesota Revenue website.

Social Security and Medicare Refunds

Non-residents for tax purposes, or F-1 students who have been in the US for less than 5 calendar years are not subject to Social Security and Medicare tax withholding (irs.gov)If your employer accidentally withheld Social Security and Medicare from your pay, you are entitled to a refund claim. Always check your W-2 for that! Sometimes even Macalester does it by mistake.

You should FIRST contact your employer for reimbursement. Share this language with your employer:

Under IRC Section 3121(b)(19) payees in a F-1, J-1, M-1, or Q-1 non-immigrant visa status are not subject to FICA.

If you are unable to get a refund from the employer, then file a claim for a refund through the IRS with the following completed forms and supporting documents after filing your tax return:

1. Complete Form 843 and Form 8316 after filing your 1040NR (as of 2021 tax year there is no 1040NR-EZ form). Important: In form 843, line 6 (labeled “Original Return”) is a common place for error. Note that the appropriate box to be checked in that item is 941 and NOT 1040. Similarly, the “Type of tax” in line 3 should be “Employment” and not “Income.”

2. Attach photocopies of:

W-2

Form 1040NR for the tax year in question

Form I-94 front and back

Form I-20 pages 1-2 (1-3 for the old I-20), with page 2 (3 for the old I-20) showing the name and address of the employer that withheld social security and Medicare from you

Valid visa

If relevant, the Employment Authorization Document of your OPT or Severe Economic Hardship work permit

3. Mail to Internal Revenue Service Center, Austin, TX 73301

4. Hold onto copies of any relevant documents Note: It may take up to a year for you to receive your refund and as a result it is very important that you keep copies of all important documents as well as list an address that will be valid for that period of time. Also, keep in mind that there is no easy way to follow up with the IRS on the status of this refund request.

Tax Related Resources and More Information

-

Form W-4

If you accept paid employment through on-campus work-study or off-campus job (with the required immigration authorization through ISP), then your employer will require you to complete a W-4 form. This form will enable your employer to figure out how much income tax to withhold. When completing the W-4, it is important that you consult the following list of instructions and visit the IRS FAQ on W-4 for additional information. Also, be sure to understand your tax status, explained below, as an international student.

Non-Resident Aliens (NRA) for Tax Purposes, which include:

- F-1 students whose presence in the U.S. does not exceed 5 calendar years (this often applies to current students and alumni within the calendar year of graduation, unless they were in the U.S. before Macalester).

- J-1 students/scholars whose presence in the U.S. does not exceed 2 calendar years.

Non-residents for tax purposes, or F-1 students who have been in the US for less than 5 calendar years are not subject to Social Security and Medicare tax withholding. If your employer accidentally withheld Social Security and Medicare from your pay, you are entitled to a refund claim. Always check your pay stub and/or your tax income statements for accidental withholding by your employer! Sometimes even Macalester does it by mistake. You should FIRST contact your employer for reimbursement. Share with your employer:

Under IRC Section 3121(b)(19) payees in a F-1, J-1, M-1, or Q-1 non-immigrant visa status are not subject to FICA.

If you are unable to get a refund from the employer, file a claim for refund with the the forms and supporting documents noted in the section above, “Filing Taxes: Step 5. Social Security and Medicare Refunds”

Important Information for Completing Your W-4

Step 1(b): You are required to enter a social security number (SSN). If you do not have an SSN, you must apply for one through Form SS-5, the Application for a Social Security Card. Access the SS-5 Form through the Social Security Administration (SSA) website, or contact any SSA office for more information. Note: you cannot enter an individual taxpayer identification number (ITIN).

Step 2(c): Check the Single or Married filing separately box regardless of your actual marital status.

Step 4(c): Write “nonresident alien” or “NRA” in the space below Step 4(c). If you would like to have an additional amount withheld, enter the amount in Step 4(c). Note: Do not claim that you are exempt from withholding in the space below Step 4(c) of Form W-4 (even if you meet both of the conditions to claim exemption from withholding listed in the instructions to the Form W-4).

Note: If you are filling out an electronic W-4 and cannot indicate your NRA status, contact your employer’s human resources (or equivalent) department.If you are contracting with your employer, then you need to complete the W-8BEN. U.S. citizens use W-9s in this situation.

For more information on filling out Form W-4 as a nonresident alien, please view the IRS’s Notice 1392, Supplemental Form W-4 Instructions for Nonresident Aliens, and visit the IRS FAQ on W-4.

Form W-8 BEN

The Form W-8 BEN is a tax form used by foreign individuals to certify their foreign status and claim beneficial tax treaty benefits or exemption from U.S. withholding tax on certain types of income. Banks may send this out to confirm a your non-resident alien (NRA) status and process taxes on interest income accordingly should the need arise.

You may use this example form* as a reference to fill out your W-8 BEN. The exact detail of of the form may differ depending on the bank; make sure to follow your bank’s instructions.

*you must be logged in to the Macalester email account to access the example form

-

How to pay/get refund

If you have to pay Federal taxes, follow this Federal taxes payment link to find your payment options.

If you have to pay Minnesota taxes, follow this Minnesota taxes payment link to find your payment options.

Check the status of your federal refund here..

Check the status of your Minnesota refund here.

-

Email us for more information and we’ll help you file your taxes through email. Given the sensitivity of tax documents, we ask that you use a secure file transfer when sending us tax documents. Please follow the below steps:

- Read the tax instructions above and fill out the Tax Survey to see what you need to prepare before sending in your documents.

- Go to macalester.leapfile.net

- Enter isp@macalester.edu as the recipient email

- Fill in the relevant information

- Attach all relevant files and click send

-

Check the “Filing Taxes: Step 1. Determining Residency Status” section above to see if this section applies to you.

Learn if you need to file federal taxes by completing this short filing survey from the Internal Revenue Services (IRS). Unfortunately, ISP can’t help you but you can easily file your federal and possibly state taxes as well using one of these online filing sites. Make sure to check whether federal/state online filing in each of these sites is free or at a cost.

You can also use an online site for federal taxes and then file your own Minnesota taxes and fill out your own Minnesota tax forms using the Minnesota Tax Filing Instruction booklet

Lastly, check out free services offered by Prepare and Prosper in Saint Paul, who help individuals making less than $35,000 and families making less than $55,000. Best of luck!

If you are looking for a 1098-T form, note that you will only be issued one if

- You received a scholarship from the college and are a resident alien for tax purposes

- You have tuition and/or mandatory fees assessed

More information about the form can be found at Student Account’s IRS Form 1098-T page.

-

If you are still a Non-Resident Alien for Tax Purposes you should continue to use Glacier Tax Prep to complete your federal return. If you must complete your state return(s), Glacier Tax Prep has a link to Sprintax, a program you can pay for to help you complete your state returns.

If you worked for Macalester and were issued a W-2, it was mailed to the permanent address that Macalester has on file. If you need another copy of your Macalester W-2, please email payroll@macalester.edu. Your 1042-S (if you received one) is accessible on Glacier.

If you are looking for a 1098-T form, note that you will only be issued one if

- You received a scholarship from the college and are a resident alien for tax purposes

- You have tuition and/or mandatory fees assessed

More information about the form can be found at Student Account’s IRS Form 1098-T page.

For more information on why you file taxes, residency status, tax treaties, GLACIER and more, see the Payroll International Visitor Tax Instructions (FAQs).

Publication 519 – U.S. Tax Guide for Aliens is also a useful source of information for preparing your tax returns.